How to Buy Cryptocurrency for Beginners: Navigating Your First Purchase with Confidence and Security

Hello and welcome. If you’re reading this, you’ve likely felt that familiar mix of excitement and trepidation. Excitement because you see the potential of Bitcoin and Ethereum—the potential for financial innovation, diversification, and growth. Trepidation because, let’s be honest, the crypto world can feel like a labyrinth guarded by complex jargon, volatile price swings, and the ever-present threat of online scams.

You’re not alone. I remember my first crypto purchase. It felt like sending money into the digital void, hoping something would stick. That moment of hesitation before the final click is universal.

You’ve searched for “How to Buy Cryptocurrency for Beginners” because you need a guide who has walked this path before—someone to demystify the process and, crucially, to help you prioritize safety above all else. This isn’t just a technical manual; it’s a mentorship, structured into seven clear, actionable steps designed to transform you from a hesitant observer into a confident digital asset owner.

We are going to cut through the noise, skip the hype, and focus on the practical Cryptocurrency Investing Steps necessary for a secure first trade. By the end of this guide, you will have the knowledge to execute your first purchase and, most importantly, the tools to protect it for the long run.

Ready to take control of your financial future? Let’s start with the hard truths first.

Step 1: The Mental Game – Setting Rules Before You Invest a Single Dollar 🧠

Every successful crypto journey begins not on an exchange, but in your own mind. Before touching any platform, we need to build a defensive and strategic mindset. This step is about preparation, patience, and perspective.

The Grand Overview: What is Cryptocurrency, Really?

Forget the technical talk for a moment. Think of cryptocurrency as digitally native, programmable money. It runs on a global, distributed network called the blockchain, which is secured by powerful cryptography. This means no single bank or government can control it, censor transactions, or print more of it at will.

- Decentralization: This is the core idea. It gives you, the individual, more sovereignty over your wealth.

- Transparency: Every transaction is recorded publicly (though your identity remains pseudonymous).

- Volatility is the Price of Admission: Unlike a savings account, crypto prices can be wild. They can soar 20% in a week and crash 30% the next. This is why our next point is the most important rule.

The Golden Rule: Only Invest What You Can Afford to Lose

I cannot stress this enough. If you need this money for rent, groceries, or next year’s tuition, it should not be in crypto.

Treat your initial investment as an experiment—a tuition fee for learning about a revolutionary new technology. If that money disappeared tomorrow, would your life be fundamentally altered? If the answer is yes, reduce your investment amount. This simple rule is your shield against making emotional, panicked decisions when the market inevitably dips.

Defining Your ‘Why’ and Your Boundaries

Why are you here? Your goals will define your strategy:

- The HODLer (Long-Term Investor): You believe in the technology and plan to hold assets (like BTC or ETH) for $5+$ years, riding out volatility. Your strategy: Buy, secure, and forget.

- The Trader (Short-Term Speculator): You want to profit from market swings. Warning: This is incredibly difficult and costly for beginners. We strongly advise against active trading until you have years of experience.

- The Explorer (Ecosystem Participant): You want to use crypto in Decentralized Finance (DeFi) or NFTs. This requires deeper technical knowledge and carries higher smart- contract risk.

Action Item: Define a specific, small dollar amount you are comfortable dedicating to this learning experience. Write it down. This is your investment budget.

Step 2: Choosing Your Digital Bank – Selecting the Best Crypto Exchange for Beginners 🛡️

If crypto is the future of money, the exchange is your entry ramp onto the highway. It’s where you convert your local currency (fiat) into digital assets. Choosing the right one is your first critical decision in the Cryptocurrency Investing Steps.

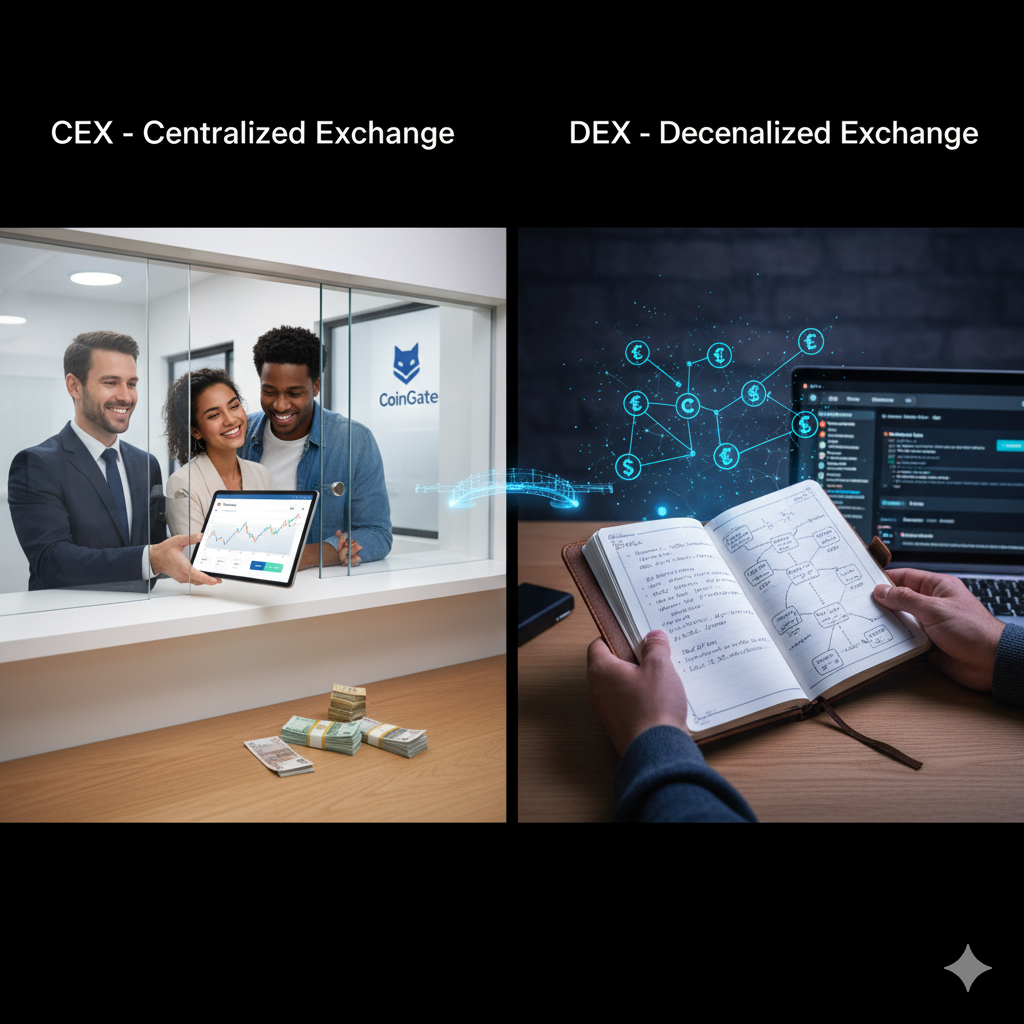

The Custody Conversation: CEX vs. DEX

For a beginner, there are two primary options, but only one is suitable for your first purchase:

- Centralized Exchanges (CEX): Think of these as Coinbase, Kraken, or Binance. They act like traditional brokerages or banks.

- Pros: Easy-to-use interfaces, excellent customer support, fiat deposit options (connecting your bank), and often strong security measures (like insurance).

- Cons: You don’t fully control your keys (they do—this is called custody). If the exchange fails or is hacked, your funds are at risk.

- Verdict for Beginners: Essential for your first purchase. They simplify the complex process.

- Decentralized Exchanges (DEX): These are peer-to-peer, automated marketplaces (e.g., Uniswap). They require a separate wallet and are far more complex.

- Verdict for Beginners: Avoid for now. You can explore DEXs once you are comfortable with self-custody (Step 5).

What Makes an Exchange the ‘Best Crypto Exchange for Beginners’?

When you are learning how to buy cryptocurrency for beginners, prioritize these three factors:

- Regulatory Compliance and Trust: Is the exchange registered and compliant in your jurisdiction? Look for companies that have been operating for years and have built a reputation for transparency (e.g., Coinbase, Gemini).

- User Experience (UX): The platform should feel clean and intuitive, not cluttered with complex charting tools. Look for simple “Buy/Sell” options. A good mobile app is a major plus.

- Security Features: Non-negotiable features include mandatory Two-Factor Authentication (2FA) support and proof they utilize robust cold storage solutions for the majority of customer funds.

- Fees: Fees come in various forms (deposit, trading, withdrawal). While lower fees are nice, don’t sacrifice security for a small fee discount. For small, infrequent purchases, ease of use often outweighs minor fee differences.

Internal Link Placeholder: To see how the market leaders compare on fees and features, check out our analysis: [Comparing the Best Crypto Exchange for Beginners in 2026].

Step 3: Fortifying the Gates – Account Setup and Implementing World-Class Security 🔒

Think of your exchange account as the front door to your crypto journey. We need to make this door a vault. Too many early investors lose money not to market crashes, but to poor security habits. When implementing these Cryptocurrency Investing Steps, this is the moment where vigilance pays off.

The Registration Process: KYC is Your Friend

All legitimate, regulated exchanges require Know Your Customer (KYC) verification. This usually involves:

- Basic Sign-Up: Email and a super-strong, unique password. (Use a password manager!)

- Identity Verification: Uploading a government ID (like a driver’s license) and a clear photo/selfie. This process protects the exchange from money laundering and, ultimately, protects you by ensuring only you can access your account.

- Linking Funds: Connect a payment method.

- Bank Transfer (ACH/SEPA): Slower (days) but lower fees. Recommended for first-timers as it forces patience.

- Debit Card: Instant but highest fees ($3-\$5+$ per $100). Use this sparingly.

Non-Negotiable Security Protocols (Enable These NOW)

This is the most critical technical advice in this guide. Do not proceed until these are done:

- Two-Factor Authentication (2FA) is Mandatory: If a hacker gets your password, 2FA stops them cold. Crucially, use an authenticator app (like Google Authenticator or Authy).

- Why not SMS? Text message (SMS) 2FA can be compromised by a SIM-swap attack, where a scammer tricks your carrier into porting your phone number to their device. App-based 2FA is much safer.

- Use Unique Emails: If possible, use an email address solely for your financial accounts, especially crypto, that you never use for newsletters or public forums.

- Withdrawal Whitelisting: Many exchanges allow you to pre-approve specific crypto addresses for withdrawals. Enable this. If a hacker gains access, they cannot immediately send your funds to an unknown address without a time delay (usually 24 hours).

Step 4: Executing the Trade – Your First Crypto Purchase 🛍️

The moment of truth! Your funds are in, your account is secured, and you’re ready to buy. We will execute the transaction with clarity and caution.

The Concept of Fractional Ownership

Remember that you don’t need to buy a whole Bitcoin (BTC) or a whole Ether (ETH). These assets are highly divisible.

- For Bitcoin: The smallest unit is called a Satoshi (100,000,000 Satoshis = 1 BTC).

- For Ethereum: The smallest unit is called a Wei or often referred to as Gwei.

You can use the dollar amount you defined in Step 1 (e.g., $100) and buy exactly that amount of BTC or ETH.

The Transaction Walkthrough

- Find the Simple Interface: On your chosen exchange, look for the “Buy Crypto” or “Simple Trade” section. Avoid the “Advanced Trading” tab for now—it’s designed for active traders and is unnecessarily complex.

- Select Your Asset: For your very first time, stick with the largest, most established assets: Bitcoin (BTC) or Ethereum (ETH). They are the least volatile of the volatile assets.

- Input the Amount: Enter the dollar amount you decided upon (e.g., $150). The system will show you the corresponding crypto amount (e.g., 0.0025 BTC).

- Review the Fees and Price: Check the final confirmation screen. It will show the total fee and the exact exchange rate you are receiving. Ensure this aligns with your expectations.

- Confirm the Purchase: Click “Buy.”

You’ve done it. You are now officially a participant in the digital economy! But the journey is only halfway complete. The biggest security mistake beginners make is stopping here.

Step 5: Becoming Your Own Bank – Selecting and Setting Up Your Crypto Wallet 🏦

This is the step that separates informed, security-conscious investors from those who are waiting to become headline news. If you want the Safest Way to Buy Crypto, you must take your coins off the exchange.

The Axiom of Self-Custody: “Not Your Keys, Not Your Coins”

When your crypto sits on a CEX, the exchange holds the Private Key—the secret, cryptographic code that proves ownership. If the exchange is hacked, goes bankrupt, or freezes your account, you might lose everything.

Self-custody means you hold the Private Key. This is the goal. Your tool for self-custody is a Crypto Wallet.

- The Private Key: Think of this as the master password for your bank account. It should never be shared.

- The Seed Phrase (Recovery Phrase): A $12$- or $24$-word phrase (e.g., “apple, tree, run, jump…”) that can regenerate your Private Key if you lose your physical wallet. This is the ultimate, non-recoverable backup. Protect it above all else.

The Best Wallet for Beginners: Hot vs. Cold

| Wallet Type | Analogy | Connectivity | Best for Beginners? | Security Level |

| Hot Wallet (Software) | Your spending cash/day-to-day wallet. | Online (mobile or desktop apps). | Yes, for small amounts and learning. | High risk if device is compromised. |

| Cold Wallet (Hardware) | A high-security safety deposit box. | Offline (physical USB device). | YES, for any amount you HODL. | Highest Security. Keys are never exposed to the internet. |

Expert Recommendation: Get a reputable hardware wallet (Ledger or Trezor) immediately. This is the single best investment you can make in your security. If you are learning how to buy cryptocurrency for beginners, a hardware wallet provides peace of mind that a hot wallet simply cannot match.

The Withdrawal Protocol: Transferring Your Funds

- Set Up Your Wallet: Initialize your hardware or mobile wallet. Crucially, physically write down your Seed Phrase on paper and store it in a secure, fireproof location. Do not take a photo, store it on a computer, or put it in the cloud.

- Get the Public Address: On your wallet interface, find the deposit address for the specific coin you bought (e.g., the Bitcoin address).

- The Test Transaction: Before sending your full balance, always send a small test amount first (e.g., $10 worth of coin).

- Go to your exchange’s “Withdraw” section, paste the public address, and send the small amount.

- Wait for it to confirm in your private wallet. If it arrives safely, you know the address is correct.

- Send the Rest: Initiate the final withdrawal of your remaining balance to your secured Crypto Wallet for Beginners.

Step 6: Due Diligence and Defense – Avoiding Crypto Scams and Common Mistakes ⚠️

Once you have secured your assets, the next battle is against information overload and malicious actors. The most successful investors are not the luckiest, but the ones who successfully avoid crypto scams and the classic Crypto Trading Mistakes.

The Power of DYOR: Doing Your Own Research

In traditional markets, you rely on financial advisors. In crypto, you are your own advisor. You must DYOR.

- Read the Whitepaper: This is the project’s foundational manifesto. Can you understand what problem it solves? If not, why are you investing?

- Evaluate the Team: Are the developers known and reputable? Anonymous teams carry inherent risks (e.g., potential for a ‘rug pull’).

- Analyze Tokenomics: How many coins are there? How are new ones created? High inflation or a small group holding most of the supply are red flags.

Mastering Your Emotions: Avoiding Crypto Trading Mistakes

Markets are designed to play on your psychology. Stay rational:

- Don’t Chase Pumps (FOMO): Fear Of Missing Out is the costliest mistake. Seeing a coin double in price overnight makes you want to buy, but you are usually buying just before the crash. Stick to your long-term plan.

- Don’t Panic Sell (FUD): Fear, Uncertainty, and Doubt cause investors to sell during a major market drop, locking in losses that they would have recovered from if they had just held on.

- Avoid Leverage Trading: This is using borrowed money to amplify returns (and losses). Beginners should never, ever touch leverage. You can lose more than your initial investment instantly.

How to Avoid Crypto Scams: A Beginner’s Guide to Defense

Assume every unsolicited message about crypto is a scam.

- The Giveaway/Multiplier Scam: “Send us 1 BTC, and we will send you 2 BTC back.” No legitimate project or celebrity (Elon Musk, etc.) is running a money multiplier. This is always a scam.

- Phishing Attacks: You receive an email that looks exactly like your exchange or wallet provider, asking you to “verify your account” by clicking a link. NEVER click a link in a crypto email. Always manually type the website address (URL) into your browser.

- The “Support” Scam: A scammer contacts you via Telegram or Discord, claiming to be “Wallet Support” and asks for your seed phrase to “fix a bug.” No legitimate support team will EVER ask for your seed phrase. Sharing it gives them your money.

- The Rug Pull: Most common in new DeFi projects. The creators build an attractive token, attract investor money (liquidity), and then suddenly drain all the funds, leaving the token worthless. Stick to proven, highly audited projects.

External Link: For real-time warnings on new scam vectors and tactics, consult the official security warnings and insights provided by established firms like [Chainalysis].

Step 7: The Long View – Holding, Taxes, and Continued Education 📚

Your initial purchase is done and secured. Now, we focus on maximizing your long-term outcome. This final step is about strategy, documentation, and making your money work for you.

Mastering the Art of HODL

HODL is more than a meme; it’s a strategy. It means ignoring the daily noise and having conviction in the long-term technological trajectory of your chosen asset.

- Dollar-Cost Averaging (DCA): Instead of trying to “time the market” (an impossible task), commit to buying a fixed dollar amount of crypto at regular intervals (e.g., $100 every month). This smooths out your purchase price and reduces the risk of buying only at the peak. This is one of the most effective Cryptocurrency Investing Steps for beginners.

Generating Passive Income: Staking

Once your assets are secured, you can explore ways to earn rewards on them. Many modern blockchains use a Proof-of-Stake (PoS) system where you can “stake” your coins to help validate network transactions.

- Staking: You lock up your coins (often for a set period) and, in return, receive a yield, paid in the form of new coins. This is generally safer than other passive income methods (like yield farming), as it’s built into the protocol itself. Reputable exchanges often offer simple staking options for coins like Ethereum.

The Unavoidable Truth: Crypto Taxes

Ignorance is not bliss when it comes to taxes. Cryptocurrency gains are generally treated as property gains by most tax authorities (like the IRS). You need to keep meticulous records.

- Taxable Events (Usually):

- Selling crypto for fiat (USD/EUR).

- Trading one crypto for another (e.g., BTC for ETH).

- Using crypto to buy goods or services.

- Earning rewards from staking or mining.

- Non-Taxable Events:

- Buying crypto with fiat.

- Transferring crypto between two wallets you own (e.g., from your CEX to your hardware wallet).

Recommendation: As soon as you begin investing, subscribe to a reputable crypto tax calculation software (e.g., Koinly, CoinTracker). Connect your exchange accounts, and it will track your cost basis automatically, saving you immense headaches later.

External Link: For a comprehensive, international overview of crypto tax obligations and software tools, review the professional guides published by [PwC’s Digital Asset Practice].

The Secret Weapon: The Crypto Journal

As a final, human touch, I recommend starting a simple journal. Write down:

- Why you bought a specific coin (your investment thesis).

- The date, the price, and the amount purchased.

- Your initial emotional state (Excited? Nervous?).

When the market crashes $50\%$, reading your original, rational thesis will often stop you from making a panicked sell, reminding you of your long-term commitment.

Conclusion: You Are Now an Informed Crypto Investor

You have successfully navigated this comprehensive guide on how to buy cryptocurrency for beginners. You didn’t just learn where to click; you learned why the steps matter:

- You established a rational, affordable investment budget (Step 1).

- You chose the right, secure starting point, moving past confusion to select the Best Crypto Exchange for Beginners (Step 2).

- You implemented vital, non-negotiable security measures like 2FA (Step 3).

- You executed your first, safe transaction (Step 4).

- You committed to self-custody, recognizing the Safest Way to Buy Crypto is to secure it in a personal Crypto Wallet for Beginners (Step 5).

- You armed yourself with the knowledge to avoid crypto scams and emotional Crypto Trading Mistakes (Step 6 & 7).

The crypto world rewards those who are patient, curious, and disciplined. By prioritizing security and knowledge, you’ve taken a monumental first step toward financial sovereignty. Congratulations on beginning this exciting new chapter.

Next Step: Secure Your Investment Today 🛡️

You’ve made the purchase—now secure it. The single most important action is securing your private keys.

Click here to find the best-rated hardware wallets and download our free, one-page resource: “The Ultimate Crypto Security Checklist.”

This checklist details the exact process for setting up your cold storage device and ensuring your crucial 12/24-word seed phrase is stored with military-grade safety. Download your checklist and lock down your digital assets now!