Introduction

Before Bitcoin, digital currency was a landscape of ambitious ideas and failed attempts. Yet, the history of cryptocurrency isn’t just about Bitcoin; it’s a rich tapestry woven with cryptographic innovation, economic theory, and a persistent human desire for decentralized finance. From the theoretical musings of cryptographers in the 1980s to today’s mainstream adoption, the journey has been revolutionary.

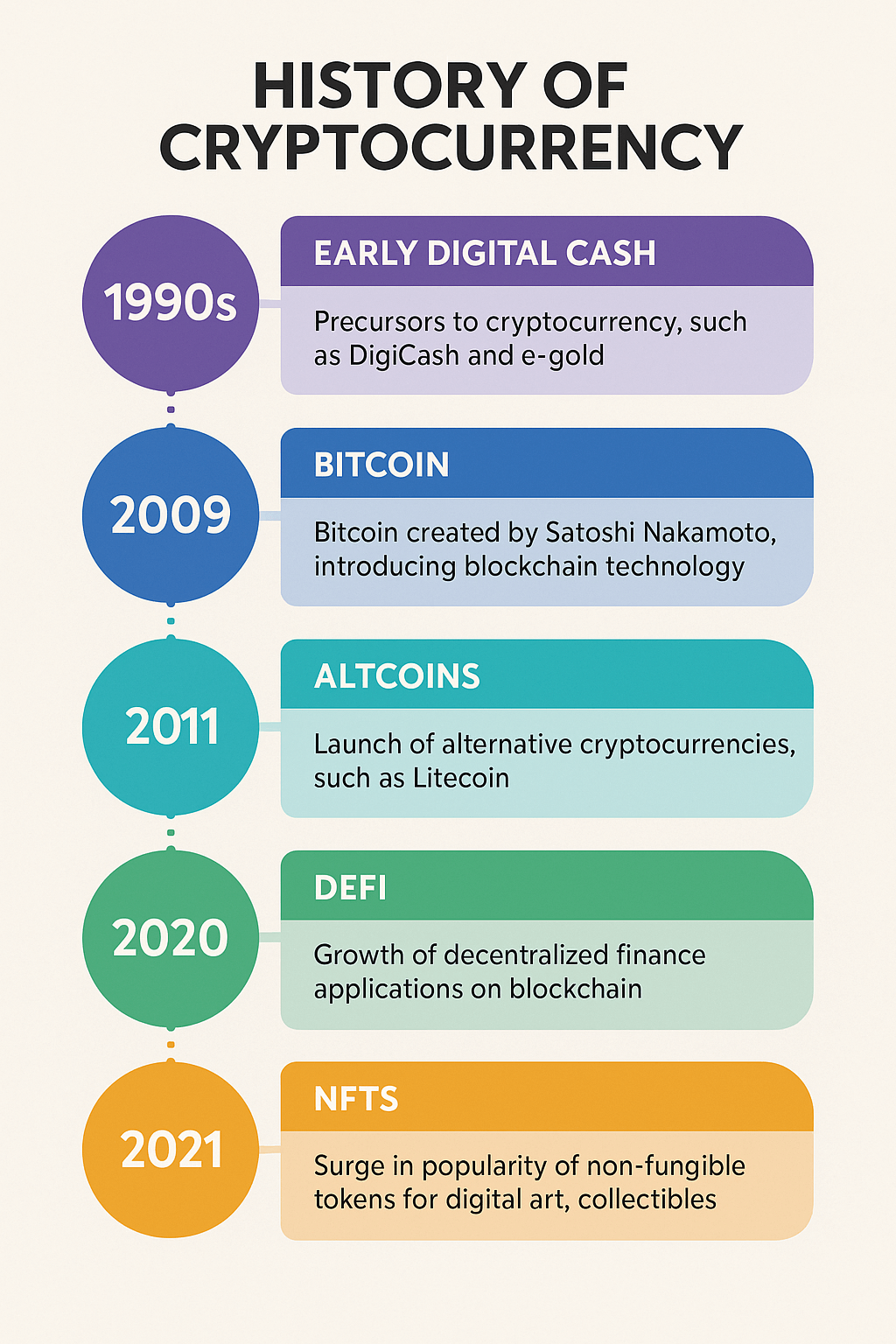

This article delves into the complete timeline of cryptocurrency, tracing its roots from early digital cash systems to the groundbreaking emergence of Bitcoin, and subsequently, the explosion of altcoins, decentralized finance (DeFi), and non-fungible tokens (NFTs). Understanding this evolution is crucial for anyone seeking to grasp the true potential and challenges of the digital economy.

What is the History of Cryptocurrency?

The history of cryptocurrency is the narrative of digital money’s evolution, from its conceptual origins to its current global impact. It encompasses the development of cryptographic techniques, pioneering efforts to create secure and anonymous digital cash, and the eventual breakthrough with Bitcoin. This history is characterized by a shift from centralized, government-controlled financial systems to decentralized, peer-to-peer networks.

Key milestones include theoretical groundwork, early digital cash attempts, Bitcoin’s creation, and the subsequent proliferation of diverse digital assets and financial applications built on blockchain technology. Understanding this context provides insight into the principles driving the cryptocurrency movement.

How Did Cryptocurrency Evolve?

The evolution of cryptocurrency can be broadly categorized into several distinct eras.

The Pre-Bitcoin Era: Early Digital Cash Experiments (1980s-2008)

Before Bitcoin, early digital cash systems laid crucial groundwork. David Chaum’s eCash, developed by his company DigiCash in the 1990s, aimed for private and secure online transactions using blind signatures. Despite its innovation, DigiCash faced adoption challenges and went bankrupt in 1998.

Other significant pre-Bitcoin concepts included:

•Hashcash (1997): Adam Back’s Proof-of-Work system combated email spam by requiring computational effort, a concept later central to Bitcoin mining.

•B-money (1998): Wei Dai’s proposal for an anonymous, distributed electronic cash system anticipated many features of modern cryptocurrencies.

•Bit Gold (1998): Nick Szabo’s system combined cryptographic puzzles into a secure, unforgeable chain, widely considered a direct precursor to Bitcoin.

These early attempts highlighted the need for a robust, decentralized digital currency.

The Birth of Bitcoin (2008-2010)

The pivotal moment arrived in October 2008, when Satoshi Nakamoto published “Bitcoin: A Peer-to-Peer Electronic Cash System.” This white paper introduced a decentralized digital currency, eliminating the need for financial institutions.

On January 3, 2009, Nakamoto mined the “Genesis Block,” launching the Bitcoin network. Bitcoin solved the “double-spending problem” using a public, distributed ledger (blockchain) and Proof-of-Work. The first real-world transaction occurred on May 22, 2010, when 10,000 Bitcoins bought two pizzas, now celebrated as “Bitcoin Pizza Day.”

The Rise of Altcoins and Diversification (2011-2016)

Bitcoin’s success inspired “altcoins” (alternative coins). Namecoin (2011) focused on decentralized domain names, and Litecoin (2011) aimed for faster transactions. This period saw the emergence of trading platforms and a diversification of the crypto landscape.

The ICO Boom and Ethereum’s Impact (2017-2018)

2017 saw an explosion in Initial Coin Offerings (ICOs), a new fundraising method. This was largely driven by Ethereum, launched in 2015 by Vitalik Buterin. Ethereum’s “smart contracts” enabled dApps and new tokens, fueling the ICO boom. While many projects failed, ICOs demonstrated blockchain’s power to democratize fundraising, also attracting regulatory scrutiny.

Decentralized Finance (DeFi) and NFTs (2019-Present)

Post-ICO, focus shifted to functional applications. Decentralized Finance (DeFi) emerged, recreating financial services without intermediaries, primarily on Ethereum. Key components include DEXs, lending protocols, and stablecoins.

Non-Fungible Tokens (NFTs), though with earlier roots, gained widespread attention in 2021. NFTs are unique digital assets representing ownership of items like art or collectibles, opening new avenues for digital ownership. Simultaneously, cryptocurrency regulation continues to evolve globally, including in the USA, addressing consumer protection, AML, and taxation.

Benefits and Use Cases of Cryptocurrency

Cryptocurrency’s history reveals a consistent drive towards addressing limitations of traditional financial systems.

Decentralization and Financial Inclusion

Cryptocurrency’s decentralization means no single entity controls the network, offering financial freedom and enabling peer-to-peer transactions. This fosters greater financial inclusion, especially in regions with limited banking access.

Enhanced Security and Transparency

Blockchain technology provides high security and transparency. Transactions are cryptographically secured and recorded on an immutable, public ledger, preventing fraud. The distributed network is resilient to censorship and single points of failure.

Lower Transaction Costs and Faster Settlements

Cryptocurrencies can offer lower transaction fees, especially for international remittances, and faster settlements (minutes vs. days for traditional banks), though fees and speed can vary with network congestion.

New Economic Models and Innovation

Smart contracts enable self-executing agreements, leading to Decentralized Finance (DeFi) for lending, borrowing, and trading without traditional banks. NFTs have revolutionized digital ownership for art and collectibles, reshaping industries.

Store of Value and Inflation Hedge

Many cryptocurrencies, particularly Bitcoin, are seen as a store of value due to their limited supply and decentralized nature, acting as a hedge against inflation and economic uncertainty.

Common Risks or Drawbacks in Cryptocurrency History

Despite its potential, cryptocurrency’s history is marked by significant challenges.

Price Volatility

Cryptocurrency is known for extreme price volatility, leading to high-risk investments. Rapid price swings are influenced by market speculation, regulation, and macroeconomic events.

Regulatory Uncertainty and Challenges

Lack of clear and consistent regulatory frameworks globally, including in the USA, creates uncertainty for businesses and investors. Governments are still defining how to classify and oversee digital assets.

Security Vulnerabilities and Scams

While blockchain is secure, the ecosystem has faced hacks, phishing, malware, and fraudulent projects. Lost funds are often unrecoverable due to the irreversible nature of blockchain transactions.

Scalability Limitations

Early blockchain networks faced scalability issues, leading to congestion, slow transactions, and high fees. Solutions like the Lightning Network and Proof-of-Stake aim to address these, but it remains a challenge.

Environmental Concerns

Proof-of-Work cryptocurrencies like Bitcoin consume substantial electricity, raising environmental concerns. This has driven a shift towards more energy-efficient consensus mechanisms and renewable energy use.

Tools, Examples, or Comparisons in Cryptocurrency History

Understanding cryptocurrency’s historical development involves examining key examples and comparisons.

Key Cryptocurrencies and Their Innovations

•Bitcoin (BTC): (2009) Solved the double-spending problem with decentralized blockchain and Proof-of-Work, establishing the foundation.

•Ethereum (ETH): (2015) Introduced smart contracts, enabling dApps, ICOs, DeFi, and NFTs.

•Litecoin (LTC): (2011) Aimed for faster transactions and a different mining algorithm, positioning itself as an efficient alternative.

•Ripple (XRP): Focuses on facilitating fast, low-cost international payments for financial institutions.

Cryptocurrency vs. Traditional Finance: A Historical Perspective

| Feature | Traditional Finance | Cryptocurrency |

| Control | Centralized | Decentralized |

| Intermediaries | Required | Peer-to-peer |

| Transparency | Opaque | Transparent (public ledgers) |

| Transaction Speed | Varies | Varies (can be faster with layers) |

| Fees | Often higher for international transfers | Can be lower, but variable |

| Accessibility | Limited | Open |

| Censorship | Susceptible | Resistant |

Evolution of Digital Assets: From Coins to NFTs

•Coins: Native cryptocurrencies (e.g., Bitcoin, Ethereum) for transactions and network fees.

•Tokens: Digital assets on existing blockchains (e.g., ERC-20 on Ethereum) representing various assets or utilities.

•NFTs (Non-Fungible Tokens): Unique digital assets representing ownership of specific items, revolutionizing digital art and collectibles.

Final Thoughts or Summary

The history of cryptocurrency is a testament to human ingenuity and the relentless pursuit of more efficient, transparent, and equitable financial systems. From early digital cash to Bitcoin, altcoins, DeFi, and NFTs, this journey has reshaped our understanding of money and ownership.

Despite challenges like volatility and regulatory hurdles, blockchain innovations continue to drive progress. Cryptocurrency has proven its resilience, constantly evolving to address limitations and expand utility. As scaling solutions, clearer regulations, and institutional adoption advance, cryptocurrency is not a passing trend but a fundamental shift in the global financial landscape. Understanding its rich history is key to navigating its promising, yet complex, future.

FAQ Section

What was the first cryptocurrency?

Bitcoin, launched in 2009 by Satoshi Nakamoto, is widely recognized as the first decentralized cryptocurrency. Earlier digital cash systems like eCash existed, but Bitcoin was the first to achieve widespread adoption and decentralization.

Who invented cryptocurrency?

The concept evolved from many cryptographers. Bitcoin, the first successful decentralized cryptocurrency, was invented by the anonymous Satoshi Nakamoto.

What are altcoins?

Altcoins are all cryptocurrencies other than Bitcoin. They aim to improve upon Bitcoin or offer different functionalities, such as faster transactions (Litecoin) or smart contracts (Ethereum).

How has cryptocurrency regulation evolved in the USA?

US crypto regulation is evolving and fragmented. Agencies like the SEC, CFTC, and FinCEN provide guidance. Efforts are ongoing to establish comprehensive federal frameworks for taxation, anti-money laundering (AML), and consumer protection.

Know More About Crypto

What is Blockchain Technology ?

Understanding Decentralized Finance(Defi) (Placeholder for an internal article on DeFi)